Now Reading: Toyota Industries’ $42 Billion Buyout Proposal Raises Valuation Questions Amid Cross-Holdings

-

01

Toyota Industries’ $42 Billion Buyout Proposal Raises Valuation Questions Amid Cross-Holdings

Toyota Industries’ $42 Billion Buyout Proposal Raises Valuation Questions Amid Cross-Holdings

Toyota Motor’s reported $42 billion bid to take Toyota Industries private may be drawing headlines, but investors and analysts are questioning whether the proposed valuation offers a true premium—or just reflects scrap value masked by complex corporate cross-shareholdings.

📌 Key Highlights:

- Toyota Motor Chair Akio Toyoda and family reportedly propose a 6 trillion yen ($42 billion) buyout of Toyota Industries.

- The target company owns 9% of Toyota Motor, which in turn holds nearly 25% of Toyota Industries.

- Toyota Industries’ stake in Toyota Motor alone is worth approximately 3.2 trillion yen ($22 billion)—about 80% of its own market cap.

- Valuation concerns are mounting, with analysts arguing the offer may undervalue Toyota Industries’ operational assets.

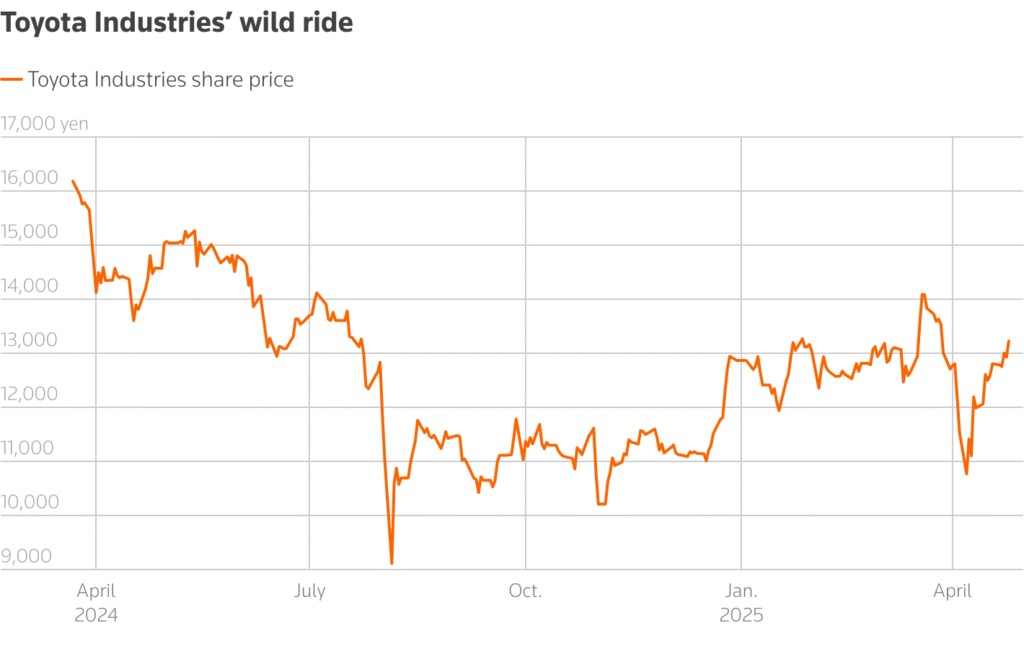

- Toyota Industries’ shares surged 23% following the buyout speculation, while Toyota Motor stock rose 3.6%.

🔄 Cross-Shareholdings Complicate True Valuation

Toyota Industries (TSE: 6201) started as a textile machinery manufacturer—the original company from which the global Toyota Group was born. Though its loom-making roots now account for just 2% of revenue, it has grown into a diversified industrial giant. Yet, the company’s cross-ownership with Toyota Motor (TSE: 7203) complicates how the market and potential acquirers value it.

At Friday’s market close, Toyota Industries’ 9% stake in Toyota Motor was worth more than $22 billion. When you add its holdings in 27 other companies, most of the firm’s market value seems tied to investments rather than its own operations.

🏭 Underappreciated Core Business Units

While Toyota Industries supplies engines, electronics, and RAV4 assembly to Toyota Motor, these segments represent less than 20% of its operating income, with operating margins below 4%, compared to nearly 10% at Toyota Motor.

However, the company’s Materials Handling Equipment division, the world’s largest forklift manufacturer, contributes approximately 75% of operating income. Analysts estimate this division will push total earnings to 280 billion yen this year.

Applying a conservative 12x earnings multiple—similar to German rival Kion Group (XETRA: KGX)—the standalone business could be worth 3.4 trillion yen. Add that to the Toyota Motor stake and you get an implied valuation of 6.6 trillion yen, 10% more than the proposed buyout.

If the 6 trillion yen offer includes debt—as reported by the Financial Times—the implied equity value drops closer to 4.8 trillion yen, deepening concerns the offer undercuts shareholders.

🧾 Shareholders Urged to Scrutinize Offer

So far, minority shareholders haven’t priced in the full value of Toyota Industries’ holdings or business operations. But with the possibility of a lowball offer, investor activism or demand for a fairer valuation could increase.

The company has acknowledged receiving proposals to go private via a special purpose vehicle, but denied that any official bid has come from Akio Toyoda or the Toyota Group.

📈 Stock Market Reaction

- Toyota Industries shares jumped 23% on April 28, hitting the daily trading limit, after Bloomberg reported the potential buyout plan.

- Toyota Motor shares closed up 3.6% after confirming interest in participating in a potential deal.