Now Reading: AI Investment Boom Faces Headwinds from U.S.-China Tariffs and Global Economic Uncertainty

-

01

AI Investment Boom Faces Headwinds from U.S.-China Tariffs and Global Economic Uncertainty

AI Investment Boom Faces Headwinds from U.S.-China Tariffs and Global Economic Uncertainty

The ongoing artificial intelligence (AI) boom in the U.S. is beginning to feel the pressure of escalating U.S.-China trade tensions, rising tariffs, and global economic uncertainty. Despite soaring investments from tech giants like Google (Alphabet), Microsoft, and Amazon, industry analysts warn that supply chain disruptions and slowing client spending could dampen the AI gold rush.

The surge in AI spending across industries – from software to energy – may slow down as rising tariff costs, particularly on AI data center hardware and infrastructure imported from China, begin to impact project feasibility and long-term ROI.

AI Infrastructure Faces Tariff Threats and Supply Chain Disruption

China, a critical hub for AI hardware manufacturing, was excluded from a 90-day tariff reprieve issued earlier this month. With the U.S. now imposing 145% tariffs on Chinese goods, costs for building and maintaining data centers could rise sharply.

“Much of the electrical infrastructure and data center equipment comes from overseas. Tariffs may worsen shortages and push suppliers to other markets,” said Pat Lynch of CBRE.

This is particularly problematic for tech companies investing billions into AI infrastructure, as analysts predict data center expenses could soar if electronics exemptions are revoked.

Big Tech Still Committed, But Projects Are Slowing

Despite the uncertainty, both Google and Microsoft have reaffirmed capital expenditures for the year, jointly planning to spend over $155 billion on AI infrastructure in 2025. That’s nearly half of the projected $320 billion in AI investments across the tech sector this year.

Still, signs of slowdown are emerging:

- Microsoft reportedly paused or slowed data center projects amounting to 2 gigawatts in power capacity across the U.S. and Europe.

- Amazon Web Services (AWS) delayed new data center leasing commitments, citing “routine capacity management.”

- Alphabet, Apple, and other members of the “Magnificent Seven” are expected to report slower revenue growth, despite a slightly weaker dollar offering some relief.

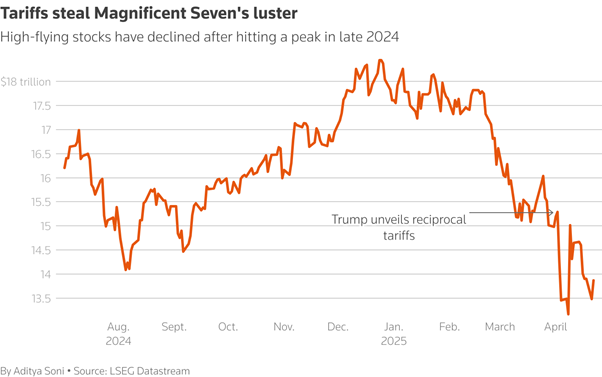

AI Stocks Under Pressure Amid Market Corrections

The broader stock market reflects investor caution. The “Magnificent Seven” tech stocks have lost approximately $5 trillion in value since their 2023 peak. Nvidia, which became the world’s most valuable firm during the AI rally, has seen its stock drop 26% year-to-date, while Alphabet is down around 20%.

Microsoft’s Azure is also expected to post its slowest growth in over a year, according to data from Visible Alpha, signaling a possible cooling of enterprise demand for AI services.

Long-Term AI Optimism Remains Strong

Despite short-term headwinds, many investors remain confident in the long-term potential of AI.

“The market has underestimated near-term AI spending. Big tech cannot afford to lose the AI race,” said Eric Schiffer, CEO of private equity firm Patriarch Organization, who recently increased exposure to the Magnificent Seven stocks.

Amazon CEO Andy Jassy also recently defended continued AI investments, calling them essential for staying competitive in the rapidly evolving AI technology landscape.