Now Reading: USMCA Exemption Lowers Mexico, Canada Tariffs

-

01

USMCA Exemption Lowers Mexico, Canada Tariffs

USMCA Exemption Lowers Mexico, Canada Tariffs

The US will impose a 10% levy on foreign goods, but an exemption for many goods shipped under the US-Mexico-Canada Agreement means the effective tariff rate for Canada and Mexico will decline. The president’s frustration over the court’s decision raises the risk he may try to radically alter or even blow up USMCA altogether in pursuit of the tariff revenue he wants.

The U.S. Supreme Court’s decision to strike down many of former President Donald Trump’s tariffs has provided temporary relief to America’s two largest trading partners Mexico and Canada. However, the broader trade relationship under the United States-Mexico-Canada Agreement (USMCA) now faces renewed uncertainty.

While the court ruling eliminates several tariffs imposed under emergency powers, the White House quickly introduced a new 10% levy on foreign goods under a different legal framework. After hours of confusion, officials clarified that goods qualifying under USMCA will remain exempt significantly lowering the effective tariff rate for both neighboring countries.

Tariff Relief But Not a Full Reset

Before the Supreme Court ruling, non-USMCA compliant goods faced steep penalties:

- 35% tariffs on Canadian products

- 25% tariffs on Mexican goods

With the exemption preserved, many goods traded under USMCA will avoid the new 10% levy, easing pressure on supply chains and reducing the effective tariff burden.

The ruling reinforces the strategic value of the trade agreement, originally signed during Trump’s first term in office. Yet, the president’s public frustration over the court’s decision has sparked concern that he may attempt to renegotiate or even dismantle the pact altogether to pursue higher tariff revenues.

The USMCA exemption ensures continued tariff-free imports of critical goods, including:

- Canadian oil and energy resources

- Automotive parts across integrated North American supply chains

- Key manufacturing inputs

This continuity helps prevent deeper disruption to industries already facing tariffs on steel, aluminum, and automobiles under Section 232 of U.S. trade law.

U.S. Trade Representative Jamieson Greer described the new tariff order as seeking “continuity,” with implementation scheduled for February 24 the same day Trump delivers his State of the Union address.

Cautious Responses From Mexico and Canada

Officials in both countries responded carefully.

- Mexico’s Economy Minister Marcelo Ebrard signaled plans to engage directly with Washington.

- Canada’s Trade Minister Dominic LeBlanc welcomed the court’s ruling, stating that tariffs under the International Emergency Economic Powers Act were “unjustified.”

However, both governments recognize that the threat has not disappeared.

As trade lawyer Barry Appleton noted:

“The president didn’t lose his leverage, he just lost a lever.”

A Growing Trade Arsenal

Despite the setback, the administration retains a broad range of trade enforcement tools.

Analysts warn the White House could:

- Expand Section 232 national security tariffs

- Launch country-specific investigations under Section 301

- Increase scrutiny of automotive and industrial exports

According to Diego Marroquin of the Center for Strategic and International Studies, extending the USMCA agreement may now become more complicated. The pact is up for review this year, and the White House has already signaled its desire for changes.

If the agreement were terminated, the economic consequences would be severe:

- Mexico and Canada rely heavily on U.S. trade for exports.

- North American manufacturing supply chains would face disruption.

- Energy and automotive sectors would absorb significant cost shocks.

The Bigger Risk: Political Uncertainty

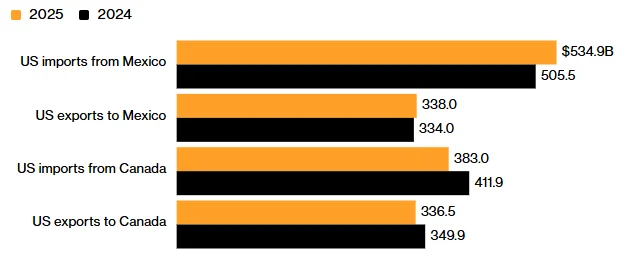

Mexico, Canada Are Biggest US Partners

Trade between the US and its two neighbors

Note: Data on a census basis

Even with reduced effective tariff rates estimated previously at roughly 3.7% for Canadian goods and 4.4% for Mexican goods uncertainty is rising.

Trump has consistently defended tariffs as both economic tools and foreign policy leverage. His comments on declining U.S. automotive jobs reinforce that trade policy remains central to his strategy.

The Supreme Court ruling may have constrained one legal pathway, but it has not eliminated the broader risk of escalating trade tensions within North America.

What Comes Next?

The USMCA review later this year will be pivotal. Investors, manufacturers, and policymakers will closely watch:

- Whether the 10% levy expands further

- If Section 301 investigations target specific sectors

- Whether renegotiation of USMCA becomes a political priority

For now, Mexico and Canada have secured short-term relief but long-term stability remains far from guaranteed.