Now Reading: Ethereum EIP-7999: Unified Fee Market Revamp Explained | Impact & Analysis

-

01

Ethereum EIP-7999: Unified Fee Market Revamp Explained | Impact & Analysis

Ethereum EIP-7999: Unified Fee Market Revamp Explained | Impact & Analysis

Ethereum, the cornerstone of decentralized applications, is poised for a transformative upgrade targeting its very core: transaction fees. Facing fierce competition and evolving user demands, the proposed EIP-7999 represents a strategic overhaul of its fee market mechanism, aiming to simplify complexity and solidify its dominance.

Beyond Tweaks: A Unified Fee Revolution

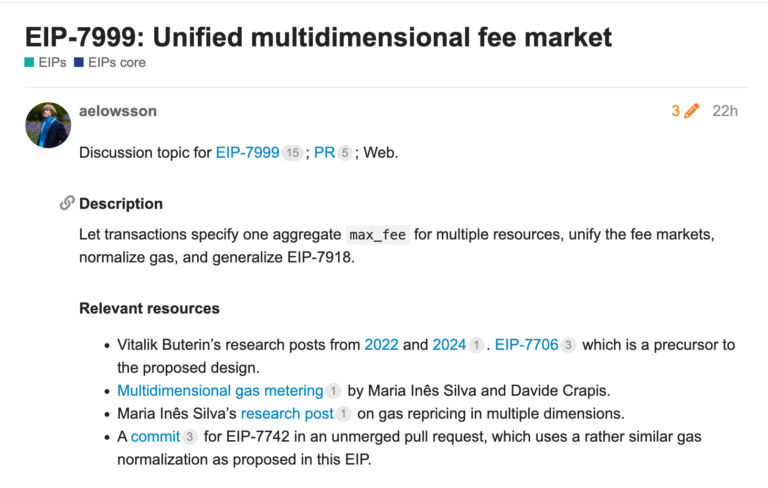

Currently, Ethereum users navigate a complex fee structure accounting for computation, storage, and bandwidth costs separately. EIP-7999 introduces a groundbreaking concept: a unified multidimensional fee market. Instead of micromanaging prices for each resource, users will simply set a single, global maximum fee cap covering all transaction aspects. This move directly addresses limitations of the EIP-1559 model implemented in 2021.

The goals are clear:

- Simplify User Experience: Make Ethereum transactions less intimidating and more intuitive, especially for newcomers.

- Enhance Efficiency: Improve resource allocation for validators, enabling smarter prioritization.

- Maintain Transparency: Ensure fee mechanics remain clear despite the simplification.

Competitive Catalyst: Answering Solana, Avalanche, and L2s

EIP-7999 emerges in a landscape where rivals like Solana and Avalanche, alongside Layer 2 (L2) scaling solutions, aggressively compete on speed and cost. While the Dencun upgrade (via proto-danksharding) significantly reduced L2 data costs, EIP-7999 tackles the mainnet fee architecture head-on.

This proposal is more than a technical update; it’s a strategic countermeasure. By streamlining fee logic and potentially improving cost predictability, Ethereum aims to retain its competitive edge and better position itself for mass adoption.

Potential Impact: Leadership or Vulnerability?

The implications of EIP-7999 are significant:

- Upside: Successful implementation could dramatically boost adoption, improve user satisfaction, reduce market fragmentation, and cement Ethereum’s leadership.

- Challenges: Validators must adapt their transaction inclusion strategies. The protocol needs to ensure the new “global cap” system remains economically viable and incentivizes network security. Technical execution and broad community consensus are critical hurdles.

The Stakes Are High

EIP-7999 is not merely an incremental improvement. It fundamentally reimagines the relationship between users, the Ethereum protocol, and network resources. Its success could propel Ethereum to new heights, reinforcing its pivotal role in the decentralized economy. Failure, however, risks ceding ground to more agile competitors. As Ethereum simultaneously tackles future threats (like quantum computing with “Ethereum Lean”), EIP-7999 represents a crucial play for its present competitiveness and long-term vision.