Now Reading: BP Reports 48% Profit Drop in Q1 2025 Amid Refining and Gas Trading Challenges

-

01

BP Reports 48% Profit Drop in Q1 2025 Amid Refining and Gas Trading Challenges

BP Reports 48% Profit Drop in Q1 2025 Amid Refining and Gas Trading Challenges

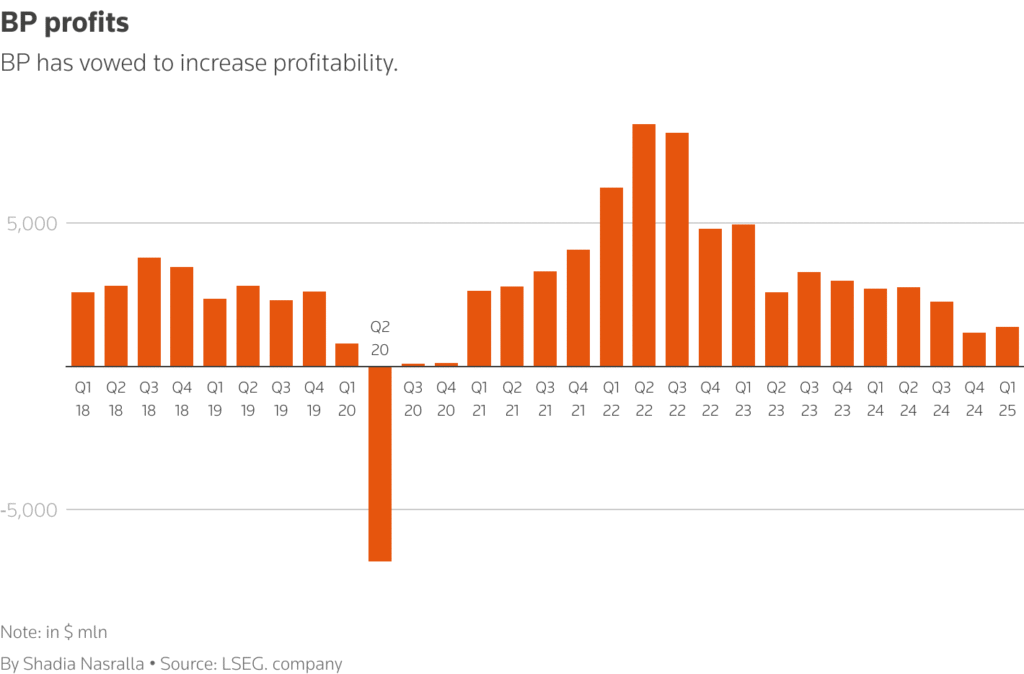

BP has announced a significant 48% decline in its first-quarter 2025 net profit, dropping to $1.38 billion from $2.7 billion in the same period last year. This performance fell short of analyst expectations, primarily due to weaker refining margins and subdued gas trading results.

Key Financial Highlights:

- Refining Margins: BP’s refining margins averaged $15.20 per barrel in Q1 2025, down from $20.60 per barrel in Q1 2024, reflecting a challenging market environment.

- Gas and Low-Carbon Unit: Profits in this segment fell by approximately 40%, impacted by lower trading volumes and reduced production following asset sales.

- Customers and Products Segment: This division experienced a 47% decline in profits, attributed to weaker fuel margins and seasonally lower volumes. bp global

Strategic Adjustments:

In response to these financial challenges and pressure from activist investor Elliott Investment Management, BP is implementing several strategic changes:

- Asset Sales: The company plans to divest up to $4 billion in assets, increasing its previous target.

- Capital Expenditure: BP has reduced its 2025 capital expenditure forecast to $14.5 billion, down from earlier projections.

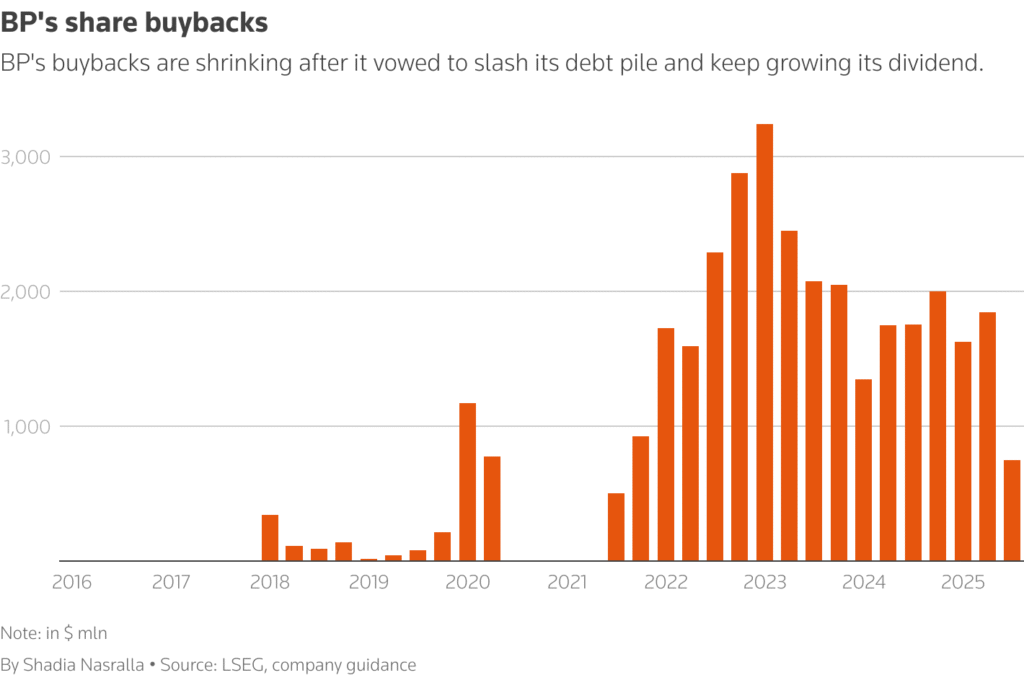

- Share Buyback Program: A $750 million share buyback has been announced for Q1 2025, a decrease from the $1.75 billion buyback in Q4 2024.

Leadership Changes:

Giulia Chierchia, BP’s strategy and sustainability chief, will step down on June 1, 2025. Her departure marks a shift away from BP’s previous emphasis on low-carbon investments, aligning with the company’s renewed focus on traditional oil and gas operations.

Market Reaction:

Following the earnings report, BP’s shares experienced a 4% decline, underperforming the broader energy sector. The company’s stock has decreased by 14% year-to-date, trailing behind competitors such as Shell and Total Energies.

Outlook:

BP’s CEO, Murray Auchincloss, has indicated that the company will continue to prioritize cost reductions and operational efficiency. The company aims to deliver at least $2 billion in cash cost savings by the end of 2026, relative to 2023 levels. bp global+1Business Standard+1