Now Reading: 10 Essential Tips to Save Your Business from Running at a Loss

-

01

10 Essential Tips to Save Your Business from Running at a Loss

10 Essential Tips to Save Your Business from Running at a Loss

Introduction: Understanding the Crisis

Running a business at a loss is an alarming situation that can jeopardize the future of any enterprise, regardless of its size or industry. This phenomenon, often referred to as a financial crisis, manifests when a company’s expenses surpass its revenues over a specified period. The reasons behind this alarming trend can vary significantly, affecting both established and new businesses.

Several factors contribute to a business operating at a loss. For instance, poor financial management can lead to overspending and an inability to accurately forecast revenues. Additionally, market fluctuations, increased competition, or changing consumer preferences can result in sudden drops in sales. External pressures, such as economic downturns or increased operational costs, may also intensify financial strain.

It is crucial for business owners to recognize the signs of distress early on. Ignoring the indicators can lead to a further decline in financial health, potentially resulting in insolvency. Proactive measures, such as comprehensive financial analysis, identifying profitability issues, and revising business strategies, are essential to address these challenges. Moreover, understanding the root causes of financial losses allows business leaders to implement targeted solutions that enhance operational efficiency and restore profitability.

By remaining vigilant and responsive to financial conditions, business owners can navigate through the tumultuous landscape of losses. Effective strategies will not only halt the financial bleeding but also pave the way for sustainable growth and stability in the future. The primary focus should always be on creating value and ensuring that the business can maintain its essential operations while adapting to a continuously evolving market.

Tip 1: Conduct a Comprehensive Financial Review

To ensure your business avoids running at a loss, conducting a comprehensive financial review is pivotal. This should be initiated by gathering all financial statements, including income statements, balance sheets, and cash flow statements. A meticulous analysis of these documents allows you to gain insights into your business’s fiscal health and performance over a defined period.

Begin with scrutinizing your revenue streams. Identify which products or services generate the highest returns and which ones are underperforming. This analysis is foundational in highlighting the areas where your efforts should be concentrated. Subsequently, venture into assessing operational costs, which encompass all expenditures necessary for running your business. Scrutinizing variable and fixed costs helps in pinpointing sectors of excessive spending that may not contribute to your bottom line.

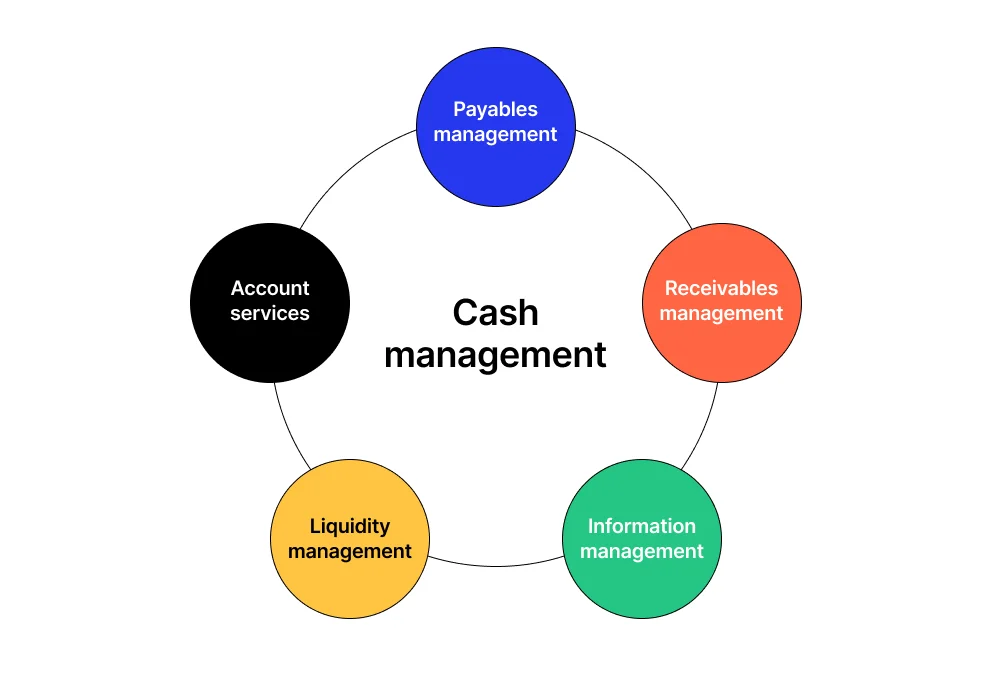

Next, a thorough examination of your cash flow is necessary. Cash flow can be described as the net amount of cash being transferred into and out of your business. Understanding cash flow dynamics is crucial as it influences your ability to sustain operations and make necessary investments. Identify patterns in cash flow, observing when peaks or troughs occur, which can lead to more strategic financial planning.

Additionally, look for any trends indicating declining sales over time. It may be beneficial to segment your sales data by product line or service type to determine if there are specific offerings lagging. By recognizing these trends early, you can take swift, corrective actions to address potential issues before they lead to detrimental financial losses.

In conclusion, a well-executed financial review lays the groundwork for informed decision-making. By focusing on revenue, costs, cash flow, and sales trends, you are better positioned to implement strategies that will safeguard your business from operating at a loss.

Tip 2: Identify and Cut Non-Essential Expenses

In any business operation, managing expenses is crucial for maintaining profitability. One effective strategy to prevent your company from running at a loss is to identify and eliminate non-essential expenses. These expenditures do not contribute to key operations or business growth and can easily drain your resources over time.

To begin, conduct a thorough review of your current budget. Identify fixed and variable costs, focusing particularly on discretionary spending that could be reduced or eliminated. For instance, consider whether premium subscriptions of services are necessary or if standard plans would suffice. Assess your current vendors and suppliers; renegotiating contracts can lead to better rates without sacrificing quality.

Prioritizing spending is essential. Create a list of expenses categorized by necessity and impact on your core business functions. Rank them based on their direct contribution to revenue generation and operational efficiency. This method allows you to understand where cuts will have the least detrimental effect while preserving the integrity of your business.

Moreover, involve your team in this process. Engaging employees can yield insights into various operational aspects that may warrant reduction or adjustment, as they are often aware of inefficiencies that management might overlook. Team discussions can foster innovative ideas on how to streamline processes, ultimately leading to cost savings.

Making tough decisions regarding budgets may be challenging, yet it is critical for the health of your business. Focus on creating a leaner financial structure, emphasizing efficiency without compromising quality. By effectively cutting non-essential expenses, businesses can allocate resources towards initiatives that drive growth and security, consequently steering clear of losses.

Tip 3: Revise Your Business Model

In today’s rapidly evolving market landscape, revising your business model is essential for sustainable success and to prevent financial losses. A thorough assessment of existing operational frameworks can illuminate areas that need strategic modifications. Businesses must remain vigilant to shifts in consumer preferences and emerging market trends, as failing to adapt can lead to irrelevance.

To begin the revision process, conduct a comprehensive analysis of your current business model using tools like the Business Model Canvas. This will enable you to map out critical components, including value propositions, customer segments, revenue streams, and cost structures. Identify areas where your offerings may no longer resonate with your target demographic and explore innovative approaches that could bridge this gap.

Additionally, engaging with customers through surveys, interviews, or focus groups can provide valuable insights into their needs and expectations. This customer feedback is vital for making informed decisions about potential changes to your business model. By understanding what your customers value, you can pivot or enhance your product or service offerings accordingly, ensuring they remain competitive.

Great examples of successful business model revisions include companies that have shifted from traditional retail to online platforms or those that have innovated by introducing subscription services. These pivots not only cater to current market needs but also facilitate diversified revenue streams, reducing the risk of loss.

Lastly, it is crucial to monitor the performance of your revised business model regularly. Use key performance indicators (KPIs) to assess its effectiveness and remain adaptable. A willingness to iterate and evolve your business model continually can make a significant difference in your ability to stay profitable and resilient in a fluctuating business environment.

Tip 4: Increase Revenue Streams

In today’s competitive landscape, it is imperative for businesses to explore various avenues for generating additional income. Increased revenue streams not only help in stabilizing finances but also provide a safeguard against market fluctuations and potential downturns.

One effective method for diversifying revenue is by examining new markets. This may involve expanding geographic reach, targeting different demographics, or developing tailored marketing strategies for underserved customer segments. Conducting market research can shed light on opportunities where your current products or services may fit well.

Additionally, diversifying product lines can significantly contribute to revenue enhancement. Consider innovating your existing offerings or creating complementary products that align with consumer interests. For instance, if your business specializes in selling outdoor gear, you could introduce related services, such as expert-guided tours or workshops on wilderness survival. This not only caters to the current customer base but also attracts new clients looking for holistic experiences.

Another avenue to explore is the introduction of subscription models or membership services. Such arrangements create a steady income flow and foster customer loyalty. For businesses that thrive on customer interaction, offering premium memberships can enhance user experience while generating higher returns.

Lastly, leveraging digital platforms and e-commerce can greatly amplify reach and revenues. Establishing an online presence enables businesses to tap into wider markets while also providing convenience to customers. By promoting your products or services through social media, email marketing, or collaborations, you can create new sales opportunities.

Incorporating these strategies to increase revenue streams can help safeguard your business against financial challenges. Emphasizing innovation, market exploration, and customer engagement will not only secure growth but also position your venture more resiliently within the industry.

Tip 5: Invest in Marketing and Customer Engagement

Investing in marketing and enhancing customer engagement are pivotal strategies for businesses aiming to avoid running at a loss. Effective marketing not only broadens visibility but also helps foster relationships with consumers, thereby driving potential sales. In today’s competitive landscape, it is essential for organizations, regardless of size, to adopt marketing techniques that resonate with their target audience.

One of the most affordable marketing strategies is the utilization of social media platforms. By creating compelling content and interacting with customers through posts, comments, and messages, businesses can create a loyal customer base. Utilizing tools like Instagram or Facebook will allow for direct engagement with consumers, enabling businesses to understand their preferences and needs. This two-way communication can inform your product offerings and marketing efforts, setting your business apart from competitors.

Additionally, email marketing remains a cost-effective method for reaching existing and potential customers. Sending personalized emails that highlight promotions, new products, or brand stories can keep your audience engaged. Regular newsletters can remind consumers of your business presence and encourage repeated purchases. This strategy, when executed well, can significantly enhance customer retention, thereby improving sales figures.

Furthermore, leveraging customer feedback is essential. Actively seeking and responding to feedback not only shows that you value your customers’ opinions but also enables you to identify areas for improvement. Implementing changes based on consumer suggestions can lead to enhanced satisfaction and loyalty.

In essence, investing in marketing and customer engagement presents an opportunity for businesses to connect authentically with their audience while driving sales. By considering innovative and cost-effective marketing strategies, businesses can turn potential gaps into opportunities and work toward sustained profitability.

Tip 6: Seek Professional Advice and Mentoring

In today’s fast-moving business landscape, seeking professional advice and mentorship can be crucial for the survival and growth of a company. When faced with economic hardships or challenges that threaten profitability, entrepreneurs often consider reaching out to industry experts, financial advisors, and seasoned mentors. These individuals can provide invaluable insights and strategic guidance, which are essential for navigating complex issues.

Consulting with an expert can help you identify underlying problems within your organization that may not be immediately apparent. Financial advisors, for instance, possess a wealth of knowledge in assessing financial statements and projecting future cash flows. Their ability to analyze fiscal data enables them to suggest actionable strategies that can mitigate losses and enhance financial performance.

Moreover, engaging with mentors who have extensive experience in the field can provide perspectives that books or academic training cannot offer. Mentors can share firsthand accounts of their own business challenges and successes, offering anecdotal evidence that can inform decision-making processes. Their guidance can empower you to take calculated risks, which are often necessary for recovery and growth in a struggling business environment.

Utilizing professional networks can also present opportunities for collaboration and support amongst peers who have faced similar situations. These relationships can lead to a sharing of resources, strategies, and best practices that may help safeguard your company against further losses. Therefore, it is advisable to actively seek out those who can offer not only advice but also encouragement during difficult times. Building a support network can be instrumental in developing a resilient business strategy that withstands economic fluctuations.

Tip 7: Leverage Technology and Automation

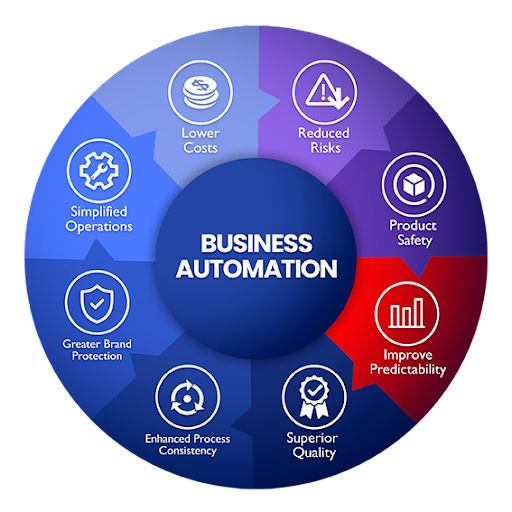

In the current business landscape, leveraging technology and automation is not merely a competitive advantage it is a necessity. The integration of technological tools can streamline operations, enhance productivity, and significantly reduce costs, ultimately safeguarding your business from running at a loss. Businesses across various sectors are increasingly adopting digital solutions to transform their processes.

One of the most effective ways to implement technology is through the automation of routine tasks. For instance, Customer Relationship Management (CRM) systems can handle customer data, track interactions, and even automate follow-ups. This not only saves time but also enhances customer satisfaction by ensuring timely and personalized communication. Additionally, marketing automation tools can manage email campaigns, social media posts, and online advertisements, allowing businesses to reach their target audience more efficiently.

Project management software is another critical tool that promotes collaboration and helps in track project timelines, budgets, and deliverables. Platforms like Trello, Asana, and Monday.com enable team members to stay organized and focused, minimizing the risk of errors that can arise from miscommunication or oversight.

Moreover, financial tracking and accounting software can enhance the accuracy of financial data management. Tools such as QuickBooks or Xero facilitate real-time monitoring of expenses and revenues, enabling business owners to identify financial losses proactively. Utilizing data analytics can provide deeper insights into key performance metrics, allowing for more informed decision-making.

Incorporating technology does not solely mean purchasing new software. It also involves training your team to proficiently utilize these tools, ensuring that your investment translates into tangible results. Embracing automation and technology can make a substantial difference in how your business operates, helping to mitigate losses and propel growth.

Tip 8: Build a Stronger Online Presence

In today’s digital age, building a robust online presence is crucial for any business aiming to avoid financial pitfalls. The internet serves as a primary platform for customer interaction, and a well-optimized online presence can directly contribute to a company’s success. To enhance visibility, it is imperative to select the right social media channels where potential customers are most active and engage them with relevant, high-quality content that resonates with their interests.

Strategically crafting your social media posts can significantly increase engagement. Use compelling visuals and clear call-to-actions to guide your audience toward taking meaningful actions, such as visiting your website or completing a purchase. Regularly updating your profiles with fresh content and insights can help maintain customer interest and loyalty. Additionally, interacting with customers through comments and direct messages fosters a sense of community and brand loyalty, essential for long-term success.

Moreover, optimizing your company’s website cannot be overlooked. A mobile-friendly and easy-to-navigate website not only improves user experience but also benefits SEO rankings, making it easier for prospective clients to discover your business. Ensure that your website runs smoothly, is aesthetically pleasing, and contains valuable content that reflects your business’s mission and services.

The enhancement of e-commerce capabilities is equally vital. Ensure that your online store is user-friendly with clear product descriptions, high-quality images, and a straightforward checkout process. Incorporating features such as customer reviews and recommendations can further bolster consumer confidence in your offerings. By prioritizing website optimization and social media engagement, businesses can solidify their online presence and potentially expand their customer base, ultimately protecting against losses in revenue.

Conclusion: Taking Action for Recovery

In the competitive landscape of business, navigating through financial challenges is a common experience for many entrepreneurs. The key to overcoming periods of loss lies in proactive measures and strategic adjustments. Throughout this article, we have explored a range of essential tips designed to empower business owners to recognize their financial positions and implement effective recovery strategies.

Taking immediate action is paramount. For instance, closely monitoring cash flows and understanding cost structures allows business owners to identify areas of leakage and opportunity. Adjusting expenditures, optimizing inventory management, and maintaining transparent communication with stakeholders are pivotal actions that can facilitate a faster return to profitability. Furthermore, investing in marketing strategies and enhancing customer engagement can lead to increased sales and thus contribute to business recovery.

As we have discussed, recovery is not a one-off effort; rather, it is a continuous journey that demands resilience and adaptability. Business owners should embrace an iterative process of evaluating their strategies, measuring results, and making necessary pivots to adapt to changing market conditions. By fostering a growth mindset and being open to innovation, companies can not only recover but also emerge stronger in the long run.

In summary, the road to recovery from financial losses requires a multifaceted approach, including detailed analysis, strategic cost management, and persistent efforts to enhance customer satisfaction. By implementing these actionable tips, business owners can pave the way toward sustainable growth and stability. Remember, the journey may be challenging, but with determination and the right strategies in place, success is achievable.

Pingback: Top Business Ideas for 2026 | Profitable & Future-Ready Startup Ideas